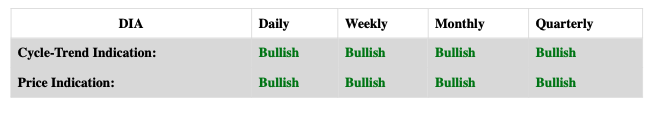

Staring with the Dow Jones Industrial Average (DIA) at the Monthly level there is clear potential for a High to form in early April and for the month to close Lower than open making it a Downside Month.

As it stands now we should see a March High/early April High with a Turn Down into May. The month of May being our next Target.

Weekly – We see that last week of the 18th opened at 388.35 and closed at 394.49 making it an Upside Week.

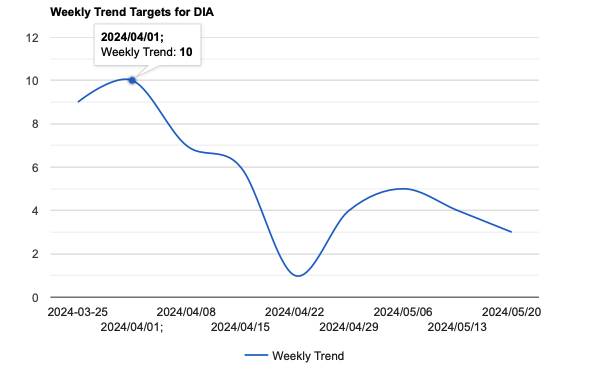

Our indicators show that we have a Trend Developing into the week of April 1st; however, Caution is Advised this week of the 25th!

If the week of the 25th is an Upside Week expect the High to form the week of April 1st. Should we see the Week of March 25th be a Downside Week then expect this trend to continue into the week of April 1st.

Weekly Trend Post April 1st – We see that there is High Potential for a new trend developing post the week of April 1st into the Target week of April 22nd. As we most past the week of March 25th we will update you on these trend indicators. Expect the Trend of the 25th to continue into either a High the week of April 1st or should the week of the 25th be downside expect a temporary-low to form the week of April 1st.

Daily – Friday the 22nd was a Downside Day; however, the week finished Upside Overall. We see that Tuesday the 26th is our Strongest Target for the week of the 25th. Should Monday be Upside expect to see a temporary High form on the 26th. Expect Rising Volatility this week on the Daily Level!

Should Monday the 25th be a continued Downside Day then expect to see a potential temp-low form on the 26th and the a reversal in the short-term trend. As it stands now The weekly Level is pointing to a continued trend into the Week of April 1st. Caution Advised!

Following the close of Monday the 25th we will make an Updated Forecast on the Daily level for all members.

S&P 500 (SPY)

March has currently inverted our cycle producing new Highs from February. Similar to DIA there is strong potential for a High to form early April and then see a downside movement into May. Should April the first week of April produce a new High and that High get surpassed the second week of April expect to then see a continued Upside Trend with May then being the next Target to move the Market downward. Caution advised until the Trend is set in motion.

Upside trend still set for now but high potential for a Turning Point coming the week of April 1st.

Weekly – The week of the 18th finished upside with the high potential for a continued trend into the week of April 1st; however, Caution Advised as this week of the 25th will strongly influence the trend into the week of April 1st. Should this week of March 25th continue the Upside trend then expect a High to form the week of April 1st which is our Strongest Target in the Weekly Level.

Volatility models show a rising Trend into the week of April 1st.

IF the week of March 25th is a continued Upside Trend then expect a High to form the week of April 1st which could form an intra-day high or see a strong thrust upward closing Friday Higher than Open.

Following the week of April 1st we see a new Trend developing from the week of the 8th into the week of the 22nd. With our Monthly Models pointing to a High and Potential for a Downside Event at this time this would further Point to a High forming the week of the 1st and then a turn down into the week of the 22nd if not the 1st week of May.

As always we will Update our Weekly Forecast at the end of the Week of the 25th.

Daily – Following the downside day of the 22nd we see that the 25th is our new Target with a trend moving into Tuesday the 26th. We see high volatility as a possibility for these targets.

From the 27th we see another Trend developing into the 1st of April which is where we have high potential for a High to form.

IF Monday the 25th is Upside then the 26th would point to an Upside Day where a temp-high can form. With the 27th being a Downside day before another Upward thrust into the 1st of April.

No responses yet