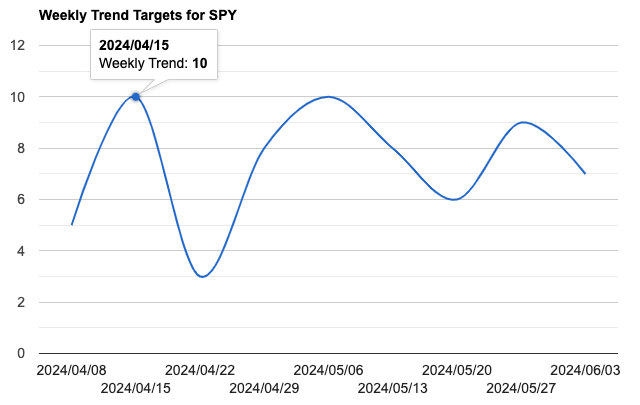

Weekly: Almost identical to DIA we see this week of the 15th is a Major Target and the most probable place to see a temporary Low form. We see two up coming change in Direction Targets. First coming the week of the 22nd and then the week of the 29th. As of now it would appears we should get a temporary low this week with a bounce into the next week of the 22nd before continuing the downward trend into the week of May 6th.

Looking at our Support Pressure Points at the Weekly level we see that so far we have not broken through. The next Major Weekly Support starts at around 453. With a lot of Daily Support in between the current price and the Target.

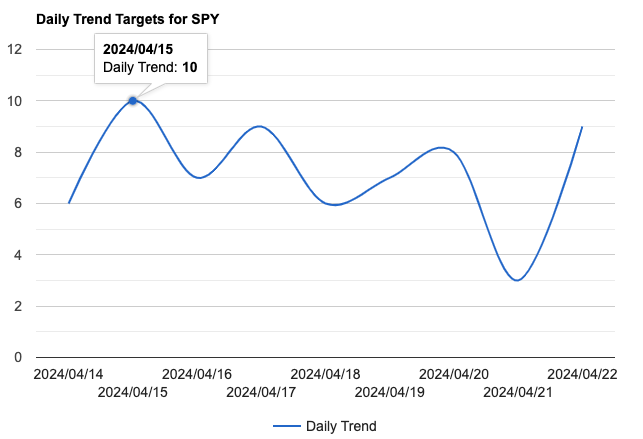

Daily Price Targets: We see that the week of the 1st broke the 520 Major Support which left us with a Gap to the 511 support area which as of Friday the 12th is now broken.

Our next Support Target comes in at 508. Should that be broken we see the 506 and 505.80 areas. Currently there appears to be a lot of Support at this area.

As we broke Support Friday that would point to the likely hood of a new low being made within the next 1-3 Days.

Using our Trend Models we can see that the 15th is a Major Target with a possible shift in Trend on the 16th and then another shift into the day of the 17th. With a Trend then forming going into the 18th into the 22nd. This week appears to be very volatile.

Shoudl the 15th form a new Low then expect a bounce on the 16th. If the 15th is Upside then expect the new temporary low to form on the 16th or the 17th.

Our Minimum Target this week if 508. Should Major Support at 505.80 be broken on a closing Level expect to see a Sharp Downside movement to occur in 1-3 Days from that event.

4 Responses

The market moved down to start today. Do you recommend trade strategy?

We do not recommend or give advise at this time. We post our forecasts that are primarily generated from our AI systems Fortuna. We can post what the computer has generated as Buy or Sell signals and potential trading strategies but once again we are NOT giving you advice or recommendations. Trade at your own risk!

When will you write bitcoin report?

I will be writing Forecasts from Fortuna on Bitcoin this weekend of the 27th.