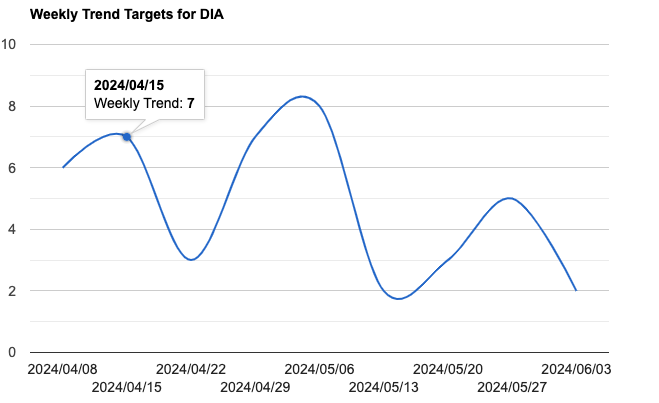

Weekly: Cleary this week of the 15th is a Target with a possible opposite direction thereafter into the week of the 22nd.

Last week being a sharply downside week we broke support pressure points for the Daily and Weekly Time level. Daily we broke through the 386 area to the 380.50 area to close the week. The weekly level closed under pressure support around the 383 area. This points to new lows ahead within the next 1-3 Weekly Time Units. As wee as further Lows on the immediate Daily level.

This indicates that we should get at the least a temporary Low this week of the 15th. Should this week turn to the Upside it would appear to be very brief before continuing a downside movement into the week of May 6th.

Weekly Price Targets: Our next Weekly Pressure Point starts at 380 folowed by 371. Should the week close under 380 expect a test of the 371 area.

Our Minimum Target going into the week of May 6th is the Target of 380 It seems highly likely we will move into the 370 area to test support.

Caution Advised for this week as we see rising Volatility. It’s possible we see a False Move to the Upside to create the momentum needed for a sharper move to the downside to test the 370 area into the week of May 6th.

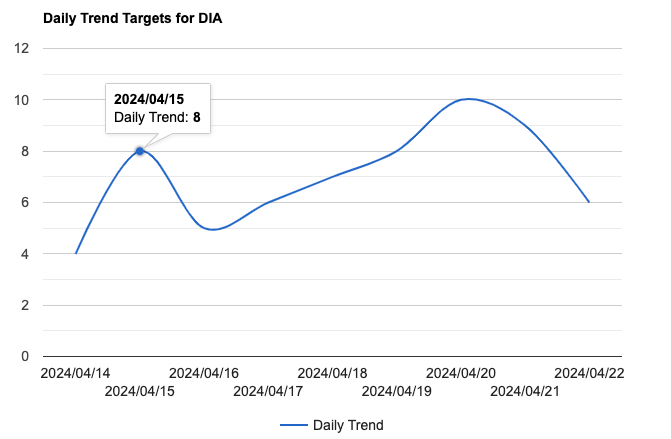

Daily: We see our Trend models are first Targeting the 15th and then a Change in Trend thereafter into the 16th. Followed by another possible change in trend on the 17th where we see this move into the Monday the 22nd.

This week as of now appears to show a lot of volatility. As mentioned above we’ve broken through a lot of Daily Support. Our next Target to make a Lower-Low is showing as either the 15th or the 16th. The critical Low may come on the 19th or even the 22nd. Caution Advised!

Our Minimum Target this week is 378 and should that be broken on a closing level that will leave the door open for a swing to the 375 area where we see support mounting at the 374 range.

2 Responses

So if a Low here we still move lower into April 22?

That is what I have written from Fortuna. As we see the markets have so far moved lower. I will write a Weekly market recap soon.